The Facts About Personal Loans Canada Uncovered

The Facts About Personal Loans Canada Uncovered

Blog Article

The 15-Second Trick For Personal Loans Canada

Table of ContentsMore About Personal Loans CanadaSome Of Personal Loans CanadaAll about Personal Loans CanadaThe Facts About Personal Loans Canada Revealed4 Easy Facts About Personal Loans Canada Explained

Repayment terms at the majority of personal finance lenders range in between one and 7 years. You obtain every one of the funds at once and can use them for virtually any function. Consumers commonly utilize them to finance an asset, such as a car or a boat, repay financial debt or aid cover the price of a significant expenditure, like a wedding celebration or a home renovation.

A fixed price provides you the safety of a predictable regular monthly payment, making it a popular selection for consolidating variable rate credit report cards. Settlement timelines vary for personal loans, yet consumers are usually able to pick repayment terms in between one and 7 years.

The 8-Minute Rule for Personal Loans Canada

You may pay a first source fee of up to 10 percent for an individual funding. The fee is generally deducted from your funds when you settle your application, minimizing the amount of money you pocket. Individual lendings prices are more straight tied to brief term prices like the prime price.

You may be supplied a reduced APR for a shorter term, due to the fact that lending institutions know your equilibrium will certainly be paid off quicker. They might bill a higher rate for longer terms understanding the longer you have a car loan, the more probable something could change in your finances that could make the repayment unaffordable.

A personal finance is additionally an excellent alternative to using bank card, because you borrow money at a fixed rate with a guaranteed reward date based on the term you select. Bear in mind: When the honeymoon mores than, the regular monthly payments will be a pointer of the cash you invested.

The Buzz on Personal Loans Canada

Prior to tackling financial debt, use an individual loan settlement calculator to aid budget plan. Gathering quotes from numerous lenders can aid you find the most effective deal and possibly save you interest. Contrast rate of interest, costs and lender online reputation before making an application for the loan. Your credit scores score is a large aspect in identifying your eligibility for the loan in addition to the rate of interest.

Prior to applying, know what your score is so that you know informative post what to anticipate in terms of prices. Watch for hidden costs and penalties by reading the lending institution's terms page so you do not wind up with much less cash money than you require for your financial goals.

Personal financings company website require proof you have the credit scores profile and earnings to repay them. They're less complicated to certify for than home equity car loans or other protected finances, you still require to show the lender you have the ways to pay the loan back. Individual finances are much better than credit scores cards if you want a set monthly payment and require every one of your funds at once.

Little Known Questions About Personal Loans Canada.

Credit report cards may additionally provide incentives or cash-back choices that individual car loans do not.

Some loan providers might additionally bill costs for individual car loans. Personal finances are loans that can cover a number of personal costs. You can discover individual financings through banks, debt unions, and online lending institutions. Personal fundings can be protected, meaning you need collateral to borrow cash, or unsafe, without security needed.

As you invest, your readily available credit score is lowered. You can after that enhance readily available credit scores by making a payment toward your line of credit. With an individual lending, there's usually a fixed end day by which the funding will be repaid. A credit line, on the other hand, might stay open and available to you forever as long as your account continues to be in great standing with your lender - Personal Loans Canada.

The cash obtained on the funding is not exhausted. If the lender forgives the financing, it is thought about a terminated financial obligation, and that amount can be exhausted. Personal finances may be secured or unprotected. A secured personal loan calls for some sort of collateral anchor as a condition of loaning. For example, you might secure a personal car loan with cash money possessions, such as an interest-bearing account or certification of deposit (CD), or with a physical possession, such as your car or boat.

The Single Strategy To Use For Personal Loans Canada

An unprotected individual financing needs no collateral to obtain cash. Financial institutions, lending institution, and online lenders can provide both protected and unsecured individual car loans to certified customers. Financial institutions typically think about the latter to be riskier than the former since there's no collateral to collect. That can mean paying a greater passion price for a personal finance.

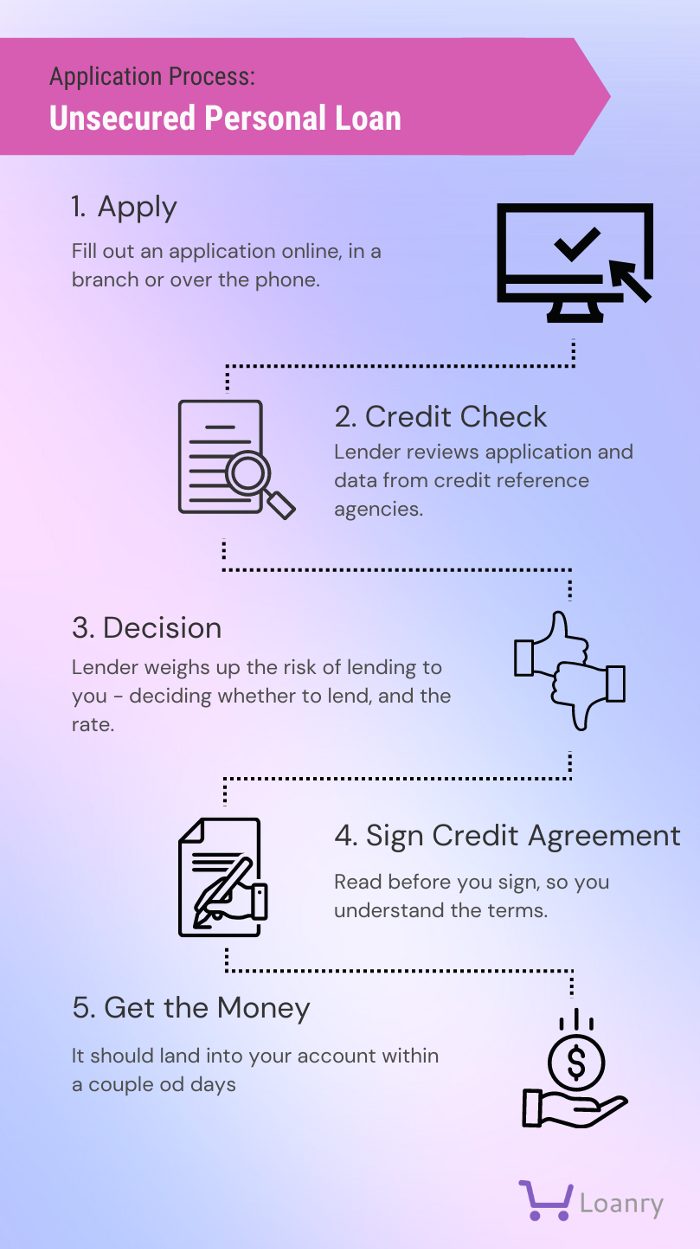

Again, this can be a bank, credit score union, or on-line personal financing lending institution. If accepted, you'll be provided the loan terms, which you can approve or decline.

Report this page